In 2017, the Board of Directors of Tadawul unveiled a five-year strategic plan for the period 2018-2022. At the time Tadawul had already achieved the distinction of being the largest and most liquid stock market not only in the GCC Gulf Cooperation Council , but in the whole MENA region.

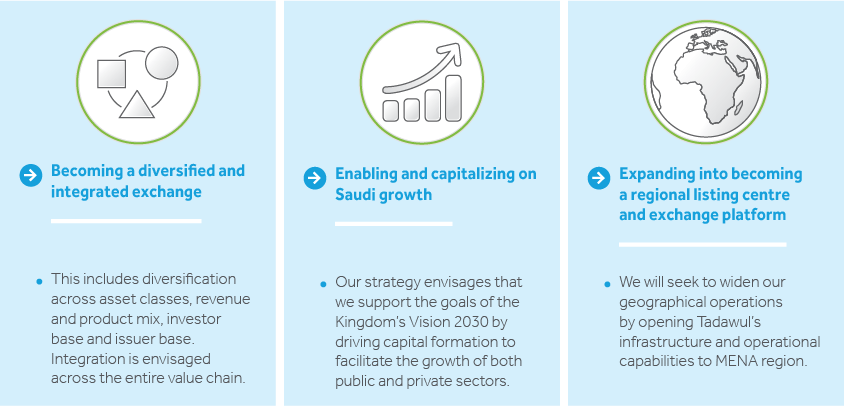

Prior to the commencement of the plan, our focus was on building infrastructure to compete regionally and achieving internal operational excellence. Our new plan has broadened our horizons to growing the Saudi Arabian capital market, its infrastructure and our competencies to enable us to compete on a global scale.

Our strategy is supported by Vision 2030, Financial Sector Development Programme (FSDP), and Capital Market Authority (CMA) strategies.

Vision 2030 is the overarching economic and social development strategy of the Kingdom. Its main themes are building a thriving economy, a vibrant society, and an ambitious nation, while one of its key pillars is for the Kingdom to become a global investment powerhouse.

Vision 2030 has a large number of specific goals and Tadawul’s activities interface with many of them. The following in particular are those to which Tadawul makes a direct contribution:

The Financial Sector Development Programme (FSDP) is one of several executive programmes developed to help achieve the objectives of the Vision 2030. The primary goal of the programme is to develop a diversified and effective financial services sector underpinned by the following three pillars:

There are several sub-objectives under the first pillar, which align with Tadawul’s mandate. One is to facilitate the raising of capital by the government and the private sector. This includes supporting the process of privatization of state-owned entities, which will open up new opportunities for investors. Another is creating an efficient platform to encourage investment and diversify the investor base. Tadawul is contributing to this objective by drawing more foreign investors, increasing the efficiency of trading, and promoting new asset classes. A third objective is to provide a safe and transparent infrastructure, that includes upgrade of the post-trade and risk management model, supported by the establishment of a clearinghouse based on Muqassa Central Counterparty Clearing House principles.

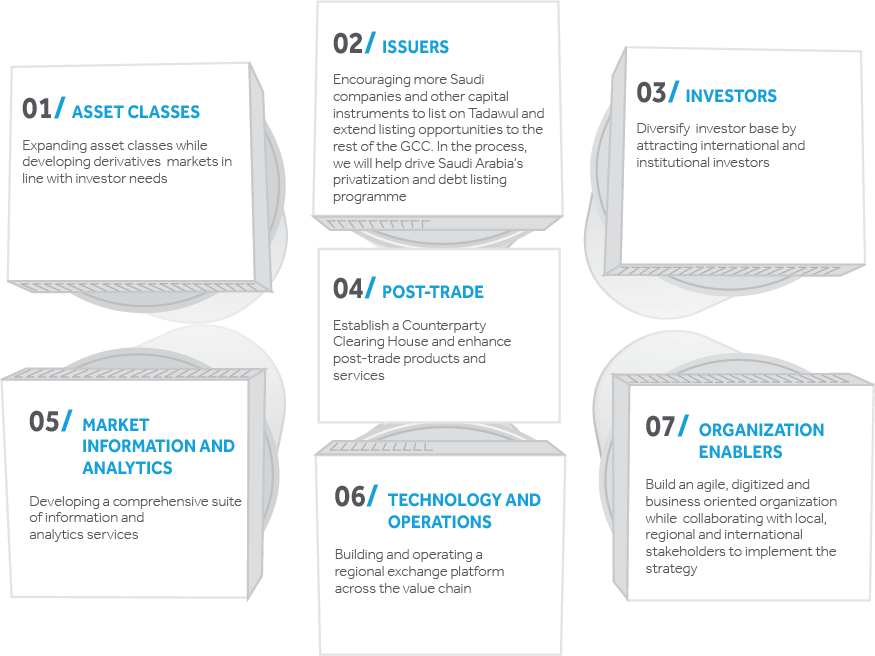

Our new plan is multi faceted, encompassing expansion into a wider range of financial instruments and markets. It also envisaged improving market infrastructure and efficiency, strengthening investor protection, and enhancing market information.

The plan has also identified 29 strategic initiatives under the seven strategic pillars. Implementation of a majority of the initiatives, commenced within the year. Progress towards strategic goals is carefully measured through a number of corporate KPIs.