Tadawul provides a robust infrastructure for market participants to conduct trading operations securely. ”

The issuing of corporate debt instruments provides a vehicle for corporates to access long-term capital other than through conventional loan and equity markets. By tapping this market, companies obtain funding for expansion, working capital and capital restructuring. Bonds issued through the debt market can be both conventional and Islamic (Sukuk). A company’s creditworthiness is demonstrated by its ability to raise funds on the debt market. Trading of Government Bonds commenced in April 2018 and there were 57 bonds listed as at end 2018. Total issuing size was SAR 540 Bn.

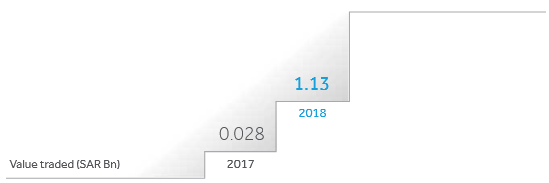

ETFs Exchange Traded Funds are investment funds consisting of a set of shares of listed companies. They are divided into equal units which are traded on the market. ETFs Exchange Traded Funds are convenient for the investor as units can be directly bought and sold on the stock market. Information on the basket of securities and the Indicative Net Asset Value is readily available.

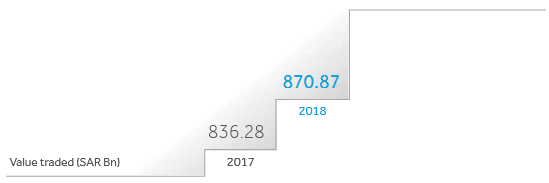

Equities are securities which represent an ownership interest in a listed company. Equities on the main market are the asset class where the bulk of the trading takes place. Tadawul provides a framework for companies to issue shares to the public for the first time through an IPO and for investors to buy and sell shares they already own through the secondary market.' Expansion of the equity market is a key factor in achieving the Vision 2030 goal of increasing the private sector contribution to the GDP from 40% to 65%. By going public companies gain access to a wide class of investors, either individual or institutional.

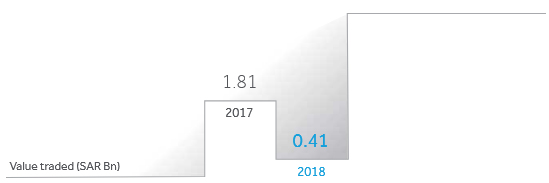

Besides the main market, Tadawul launched a parallel market Nomu, for the Small and Medium sector. SMEs are presently underserved by the financial sector. Despite the fact that they account for 22% of Saudi Arabia’s GDP, they receive only 2% of bank lending. Expanding SMEs contribution to the economy is one of the goals of Vision 2030. The requirements for an offering and a listing are less stringent than those for the main market.

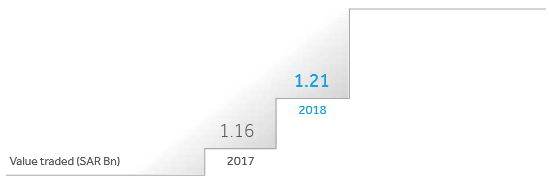

REITs Real Estate Investment Traded Funds are a financial instrument that facilitates collective ownership in developed real estate. They were introduced to the Tadawul market in 2016. The listing of REITs Real Estate Investment Traded Funds was an important step considering the role that real estate plays in the Saudi economy. The introduction of REITs Real Estate Investment Traded Funds as a separate class of security is in line with global trends. In 2016, MSCI and S&P Dow Jones Indexes moved REITs Real Estate Investment Traded Funds and other real estate companies to a new category within the Global Industry Classification Standard A standard classification system for equities developed jointly by Morgan Stanley Capital (MSCI) and Standard and Poor’s (GICS). The introduction of REITs Real Estate Investment Traded Funds paved the way for institutionalizing the real estate market.