MT30

Joint index with MSCI in 2019

The agreement for creating a joint index with MSCI was concluded during the year 2018, and is expected to contribute greatly in the development of the derivatives A security or financial instrument whose value is determined by an underlying asset market. This index will use index capping to limit the impact individual companies have on the index.

MT30 will provide investors with a useful benchmark against the largest and most liquid stocks in the Saudi market and will be of benefit to the equity market and asset managers.

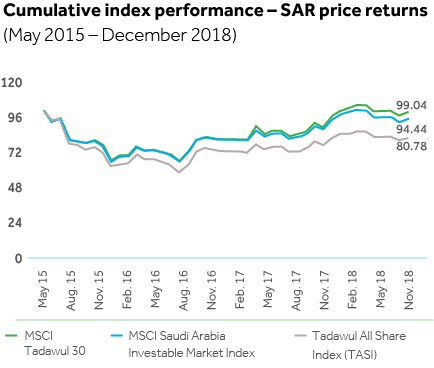

The MT30 index is based on the MSCI Saudi Arabia Investable Market Index (IMI) which represents the performance of large, medium, and small-cap stocks on the market and covers about 99% of the free-float adjusted market capitalization of the Saudi Market.

The MT30 index takes into account the top 30 securities of the IMI based on free-float market capitalization. The index is subject to capping criteria to limit the impact of single securities. At this date the largest 10 companies accounted for 73.01% of the total weightage.

Migrated to Global Industry Classification Standard (GICS) in 2017

We also launched eReference Data, a product developed to provide stakeholders with a wide range of information on the Saudi capital markets, such as equities, ETFs Exchange Traded Funds , issuers data, market news, corporate announcements, and financial statements. eReference Data is gradually receiving interest from both individual and institutional investors, helping us to move from B2B to a B2C model.