| Provider | Incentive |

|

Increased loan limits granted to listed companies |

|

Introduction of a new “premium” classification in bidding for listed companies |

|

Facilitated approval process for listed companies to register foreign partners (joint ventures) |

|

Fast tracked services at the Authority’s Business Support Centre and advisory services including training courses on the electronic systems of the Authority |

|

Priority on training programmes for listed companies, for reporting and statistical data and priority for advertisement in the ministry events |

|

Increased funding percentage, and increased credit services limits for each customer |

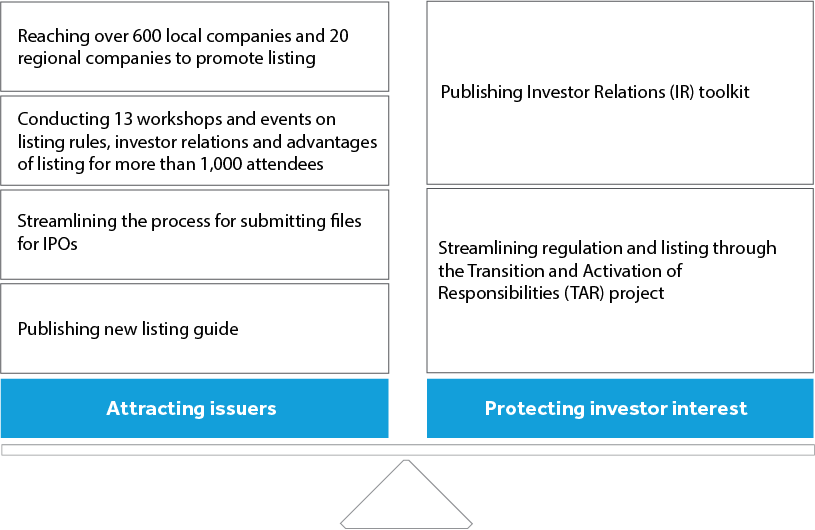

Investor Relations (IR) is a prime consideration for listed companies. The role encompasses finance, communication and marketing. A smooth flow of information between a company and its shareholders and other stakeholders is vital if it is to prosper and grow. For investors to have confidence in the Company, it is necessary to be transparent and build trust. The workshops that Tadawul conducted raised awareness on the subject. An IR toolkit was developed to guide companies through an examination of international best practices on the subject.

It is also meant to educate users on the benefits of adopting such practices.

One of the challenges we faced during the year was the lack of readiness among financial companies, issuers and investors for significant changes in the market. We have overcome this by handling all changes as far as possible between Tadawul and the CMA Capital Market Authority , thereby limiting the burden on market participants. We have also implemented a communication and awareness plan for market participants, to educate them on all changes.

In December 2018, Tadawul announced its entry into voluntary partnership with the UN Sustainable Stock Exchanges (SSE). Thereby we demonstrated our commitment to promoting sustainable development and transparency in capital markets. The SSE Sustainable Stock Exchanges will support Tadawul to engage with market participants, including issuing companies, on sustainability issues. We will also have access to a wide range of experience from other exchanges as well as investors, issuers, regulators and policy makers.

Under the Transition and Activation of Responsibilities project between the CMA Capital Market Authority and Tadawul there was a re-drawing of the division of responsibilities between the CMA Capital Market Authority and Tadawul. According to the new regulations the CMA Capital Market Authority continues to be responsible for the approval of registration and offering including the prospectus. Tadawul has taken over responsibility for the approval of listing and the timing, format and mechanisms of disclosures.

During the year, the following application approvals were granted by Tadawul:

12 Listing applications |

|

27 Listing applications for government bonds |

|

2 Capital increase applications in Nomu |

|

21 Capital increase applications in Main Market |

In addition Tadawul contributed to developing several Exchange Rules, Regulations, and Procedures including Listing Rules amendments; Trading and Membership Rules and Procedures; Security Depository Centre Rules amendments; Orders Aggregation Account Regulations: and Exchange and Centre Procedures amendments. Market Making Regulations and Procedures are under approval.

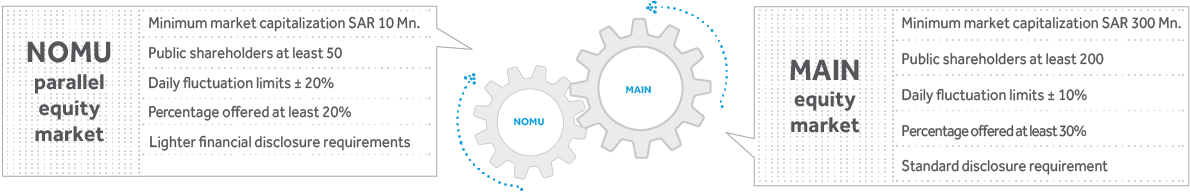

Enhancing of Nomu, a parallel market, opened the door for issuers with small and medium capital requirements to access the market. While this provided an additional source of funding for issuers to access capital, it also diversified and deepened the capital market.

At the beginning of 2018, non-resident foreigners were permitted to invest directly in Nomu. During the year, the method for determining closing prices The VWAP is an average calculated by taking the value of all trades in the last 15 minutes before the market close divided by the total traded shares of the company. If no trades occurred during the last 15 minutes the closing price will be the last normal price (trades above SAR 15,000) before the last 15 minutes was shifted from a Volume Weighted Average Price (VWAP) method to an Auction Price Method for Nomu, as was done for the main market. Nomu is in the process of being further improved in coordination with CMA Capital Market Authority . Some of the changes envisaged, which will take effect in 2019, are; allowing direct listings on Nomu without an IPO; issuers reporting earnings on a semi-annual instead of a quarterly basis; and streamlining the process for issuers to transition from the parallel market to the main market.